In our recent market updates and newsletters, we’ve emphasized that a typical presidential election cycle historically has minimal impact on market performance. However, the last month has made it clear that this year’s election is far from typical. While we continue to believe that volatility related to the political cycle will be short-term, it’s important to stay informed about the unusual developments we’ve witnessed over the past few weeks.

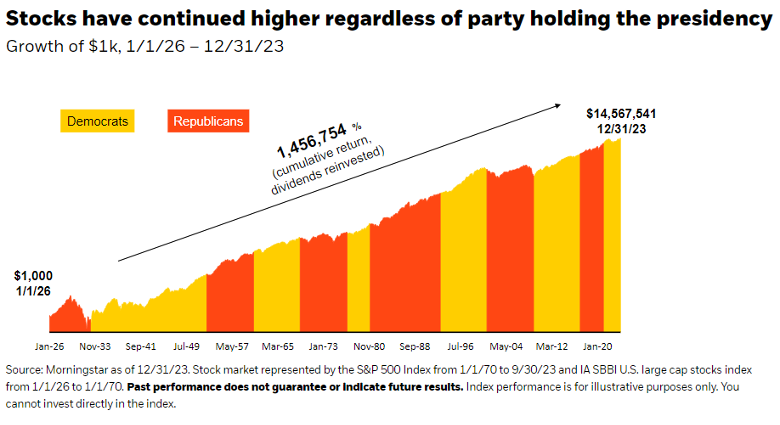

The presidential race has intensified significantly since the beginning of July, with numerous dramatic twists. We’ve witnessed an assassination attempt on Donald Trump, Joe Biden dropping out of the race, Kamala Harris taking the helm for the Democrats, and most recently, Tim Walz of Minnesota joining Harris as her running mate. Despite these events, the U.S. stock market has remained resilient, supporting the idea that elections in our country generally have little long-term impact on markets. The chart from BlackRock below illustrates that the market tends to be party-agnostic and trend upward over the long term, regardless of whether a Democrat or Republican is in office. In the current stage of the economic cycle, Wall Street experts are primarily focused on U.S. economic conditions, interest rates, and the Federal Reserve’s rate path rather than any political issue related to either candidate.

Regarding economic conditions, August has already been a challenging month for investors. The S&P 500 dropped over 10% from its recent highs before rebounding last week. The unemployment and jobs data released on August 2nd suggested that the U.S. economy might be slowing faster than expected, with only 114,000 new jobs added—falling short of consensus expectations of around 175,000. Unemployment also rose to 4.3%, which is the highest rate since October 2021 and well above analyst estimates. This slowdown has heightened concerns among economists that the Federal Reserve may have waited too long to cut rates, potentially leading to a recession and missing the “soft landing” they’ve been striving for throughout this rate cycle. However, it’s important to note that while a 4.3% unemployment rate is higher than recent levels, it remains within the healthy range for the U.S. economy historically.

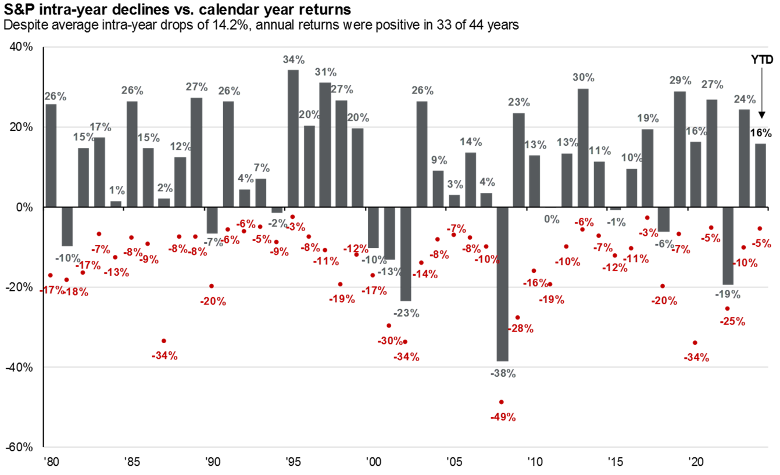

Just a month ago, most analysts expected only a 0.25% rate cut for the remainder of the year, but consensus has since shifted toward the Fed cutting rates by at least 0.50% before year-end, with the possibility of a larger 0.50%-0.75% cut in their upcoming September meeting. While this might seem concerning, it’s crucial to remember that volatility and corrections of this magnitude are not only common, but also healthy for markets as they help keep equity valuations aligned with their fair value. The chart from JPMorgan below shows annual returns for the stock market alongside the largest intra-year decline in each calendar year. As the chat depicts, the majority of years experience a correction of +10% or more, which is business as usual (albeit uncomfortable) for equity markets.

As for portfolios and investment strategy, we remain firm in our belief that staying invested and sticking to your long-term plan is essential—regardless of political headlines or election outcome predictions. Any major policy changes that might result from the election will likely take months, if not years to materialize and will likely be well-telegraphed to the market. We are also confident in our decision to extend bond duration in late 2023, as this will likely amplify the returns on the bond side of portfolios as rates finally begin to decline and stabilize. If you have any questions about the election’s impact on markets or any recent economic developments, please feel free to reach out!

Jake Fromm | Chief Investment Officer, CFS® | It is our mission to help you think differently about your wealth so you can LIVE WELLthy™ today and tomorrow.