All data and commentary as of April 3, 2024.

Equity markets showed continued resilience in the first quarter with the S&P 500 up 10%, reaching all-time highs as the tech/AI boom continued. Bond markets were less impressive, with the Barclays US Aggregate bond index down 1% for the period, as investors anticipate the direction of interest rates while the Fed prepares to cut rates later this year. While there has been no shortage of market–moving news events this year, there are 2 topics that warrant a deeper dive: the Fed and interest rates, and sector–specific dynamics across equities.

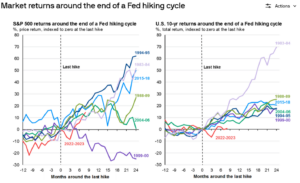

As expected, the Fed voted to leave rates unchanged in their most recent meeting in March, at a target range of 5.25%-5.50%. While the past 2 years of aggressive rate hikes have been painful for the economy and investors, signs show that inflation is moderating and analysts are predicting higher and higher probabilities of a soft landing as this trend continues alongside promising economic data releases. Most experts predict to see 2-3 rate cuts by the end of 2024, which should help ease the increased cost of borrowing that consumers and businesses have felt since 2022. Historical data also suggests that markets tend to perform in a much more consistent, upward moving pattern following the final hike in rate hiking cycle (see

chart from JPMorgan below).

Growth, technology, and speculative assets have continued the spectacular run we saw throughout 2023 in the first quarter of this year, with the “Magnificent 7” composed of Nvidia, Meta, Tesla, Microsoft, Apple, Amazon, and Alphabet up an average of 17% for the quarter, versus the S&P 500 up 10%. However, there are signs that this tech rally may be cooling off. These stocks show a remarkably high level of risk and volatility – and appear to be very richly valued at current levels. Cryptocurrency has also come back into focus with various spot Bitcoin ETFs launching earlier this year and the asset up 64% for the first quarter. While the increased availability and ease of purchase to own the asset provides plenty of tailwinds to support this increase in price, cryptocurrency is still a young and volatile asset class that is still in its early adoption phase and any significant investment into the asset class should be made with a high level of caution.

As far as your investment portfolio is concerned, we extended the duration of bonds in Q4 of 2023, which provides an opportunity to participate in the price appreciation that analysts anticipate to occur across bonds as interest rates decline in the latter half of this year. We also recommend keeping a close eye on the interest rates applied to savings/money market accounts, as these rates are likely to decline later this year and those funds may be better served invested in traditional bonds in this environment (unless the assets are needed in the next 6-12 months for an upcoming cash flow need).

On the equity side of portfolios, we believe a balanced, risk aware approach is prudent in this environment. While the Magnificent 7 rally may have some more room to run in the immediate future, it is important to maintain a balanced mix of growth and value-oriented equities to reduce volatility over shorter periods and smooth returns over the long run. While a small sleeve of growth equities provides potential for continued capital appreciation, stable, mature firms with strong management and free cash flow distributions may be better positioned to withstand any economic headwinds that develop as we move through this year.

Jake Fromm | Lead Investment Analyst, CFS® | It is our mission to help you think differently about your wealth so you can LIVE WELLthy™ today and tomorrow.